Solving Spruce’s $250K Problem

Spruce is a prop-tech/fintech platform that simplifies title and closing services across the U.S..

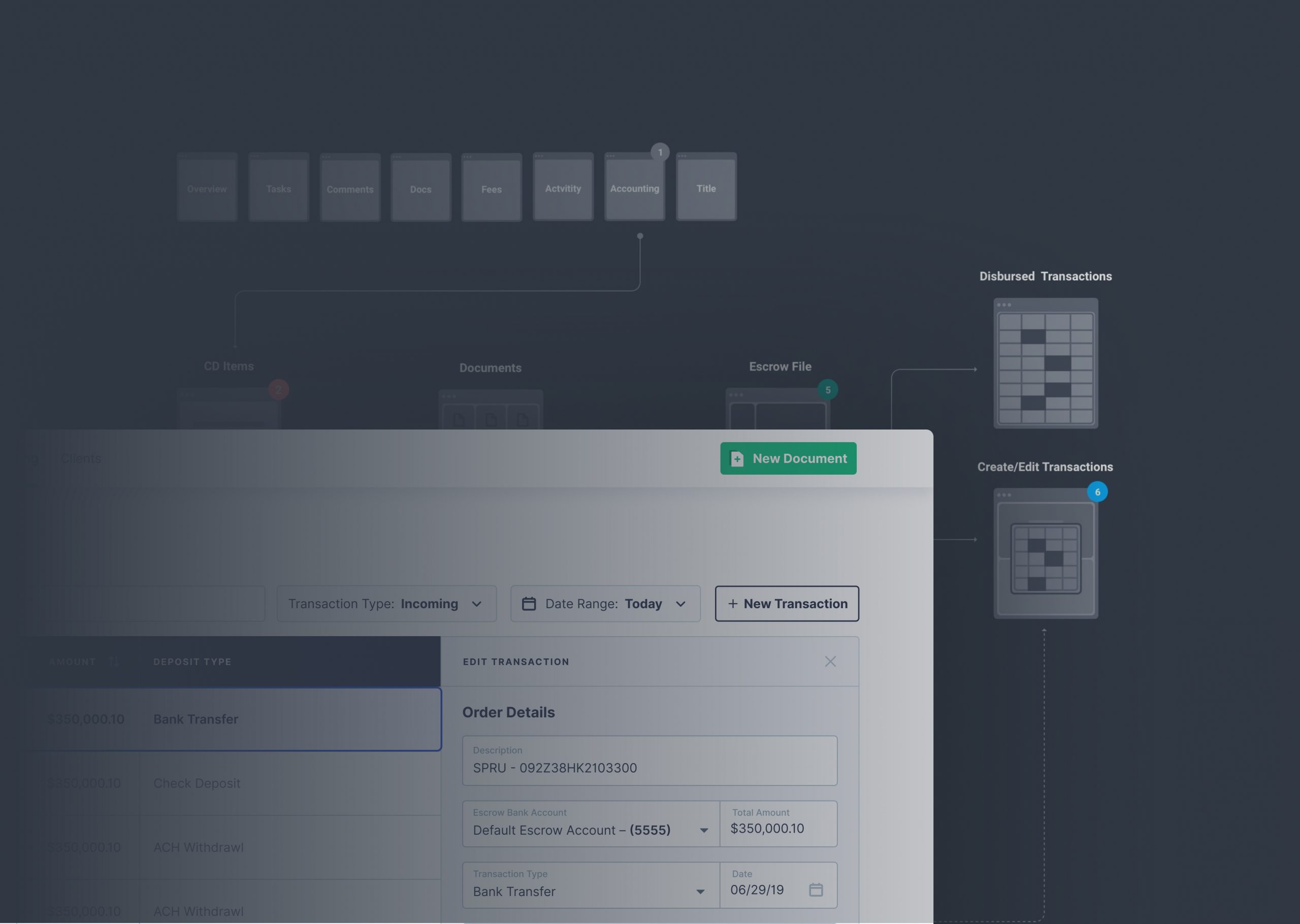

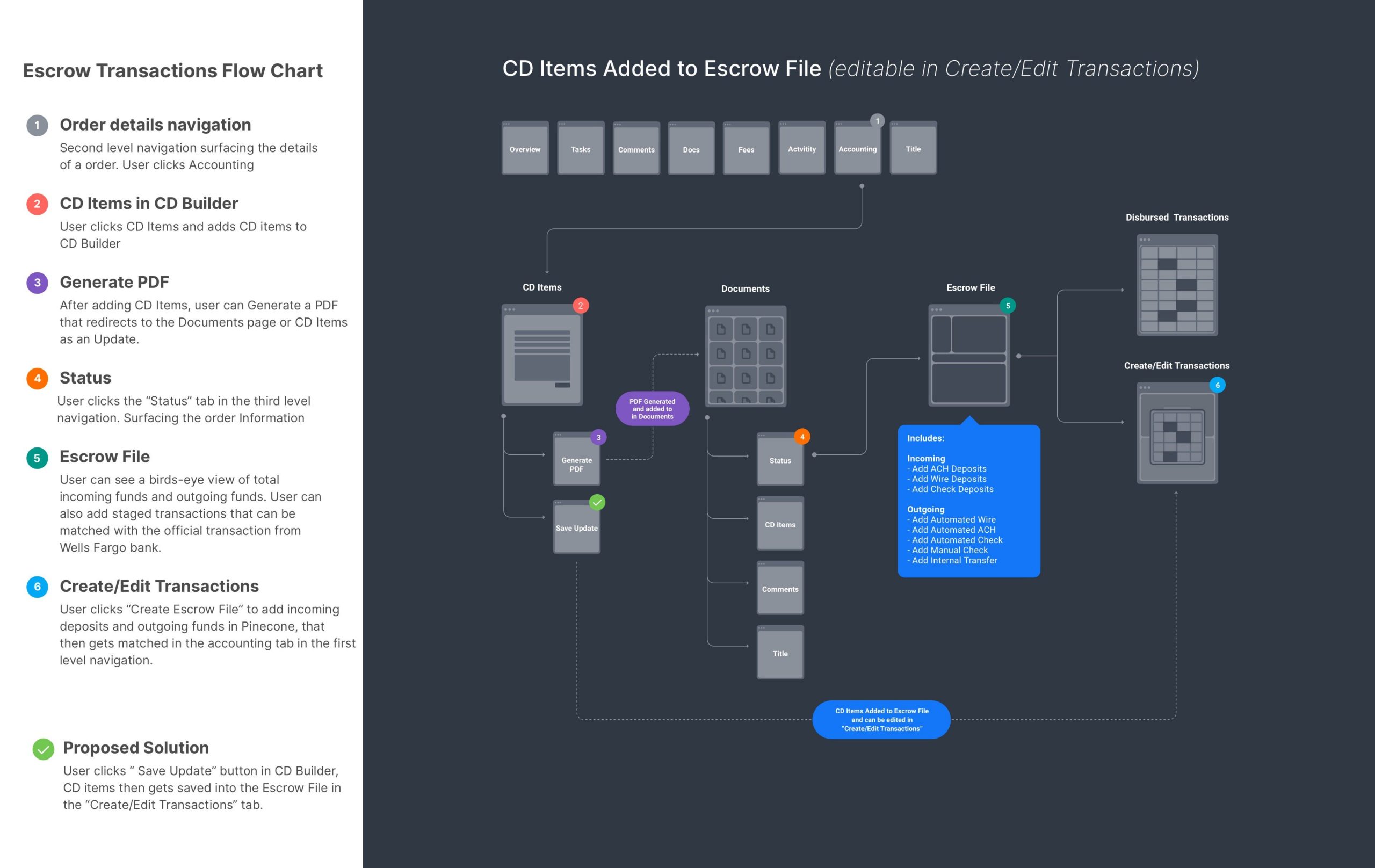

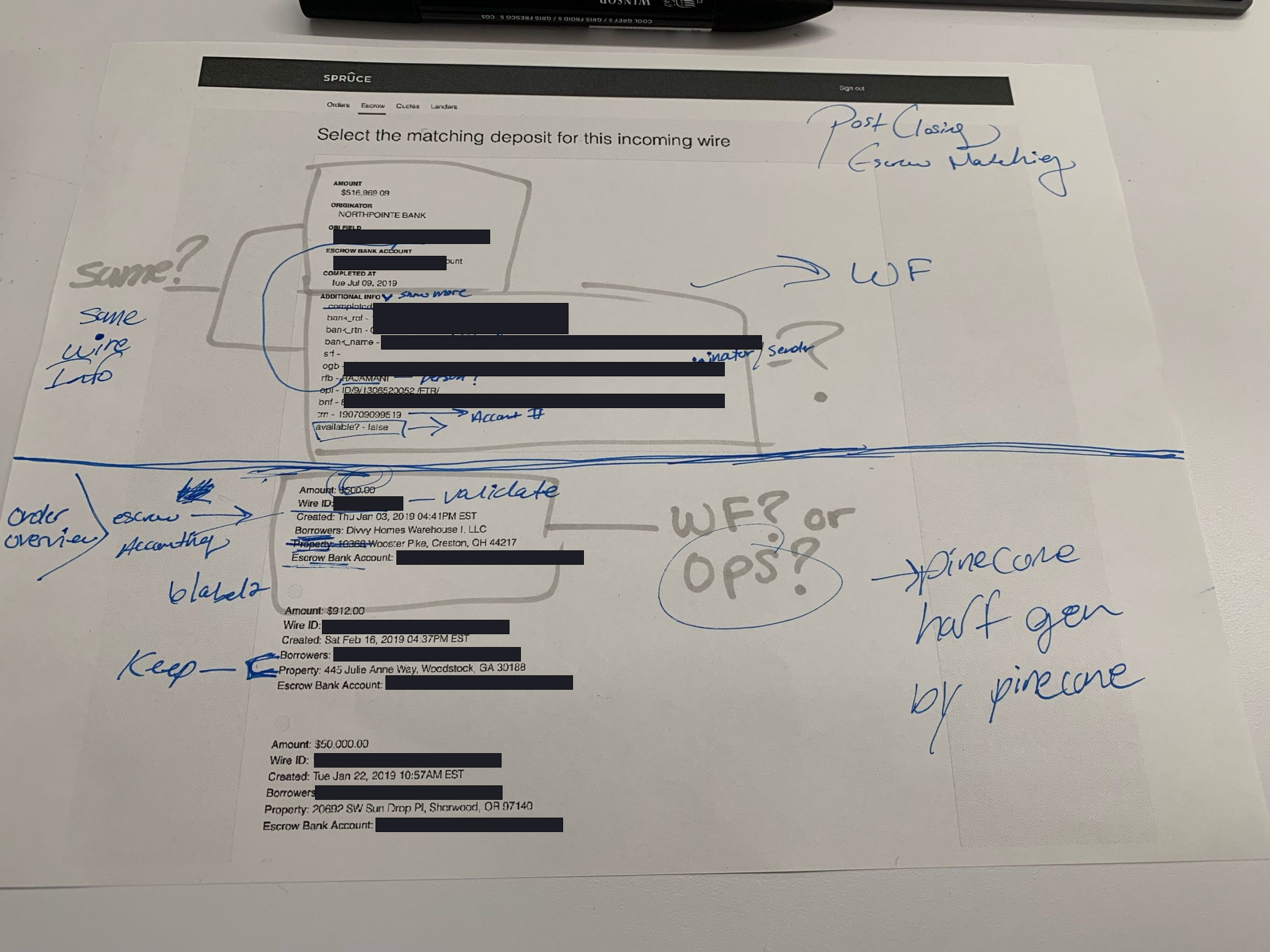

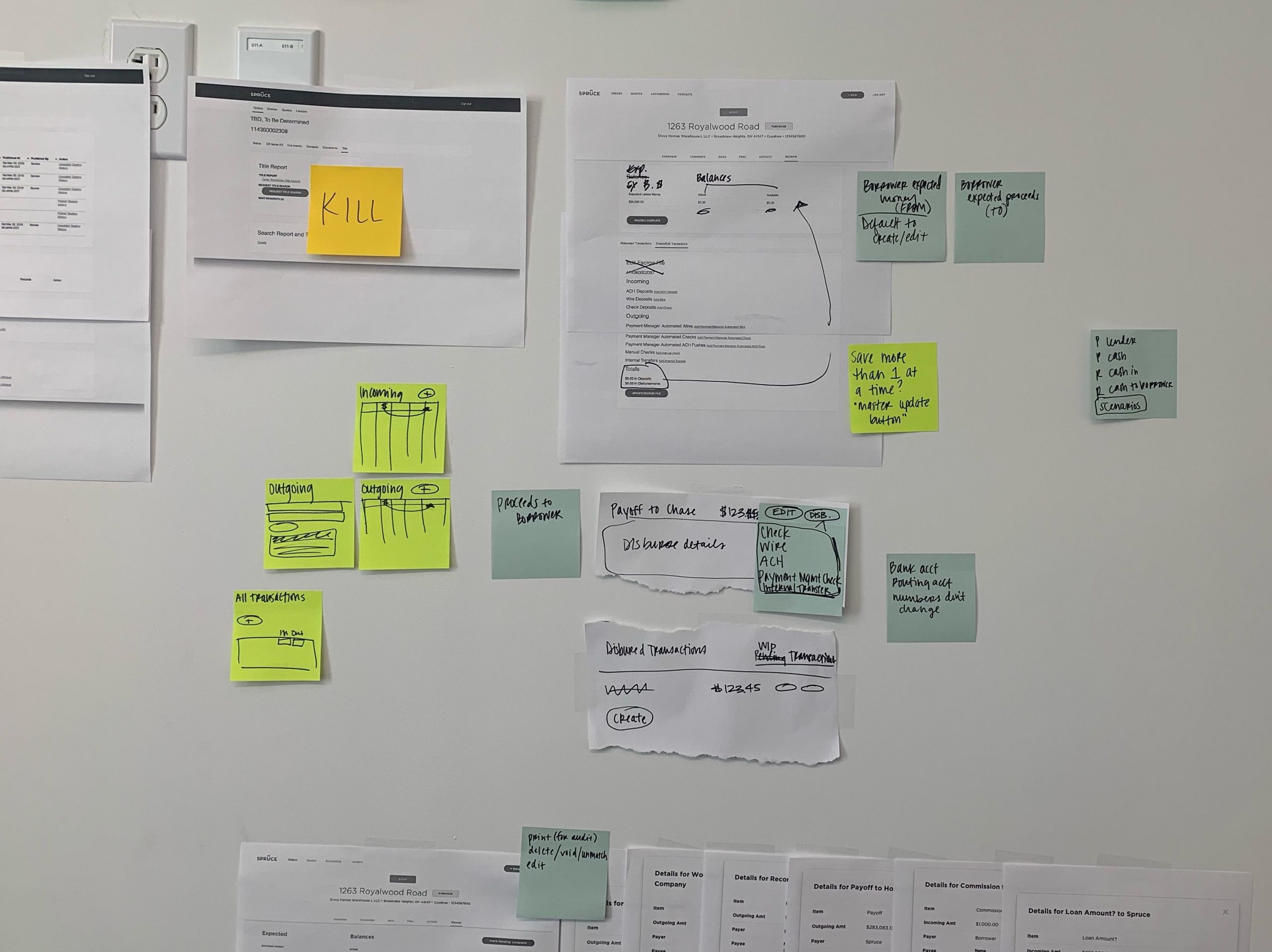

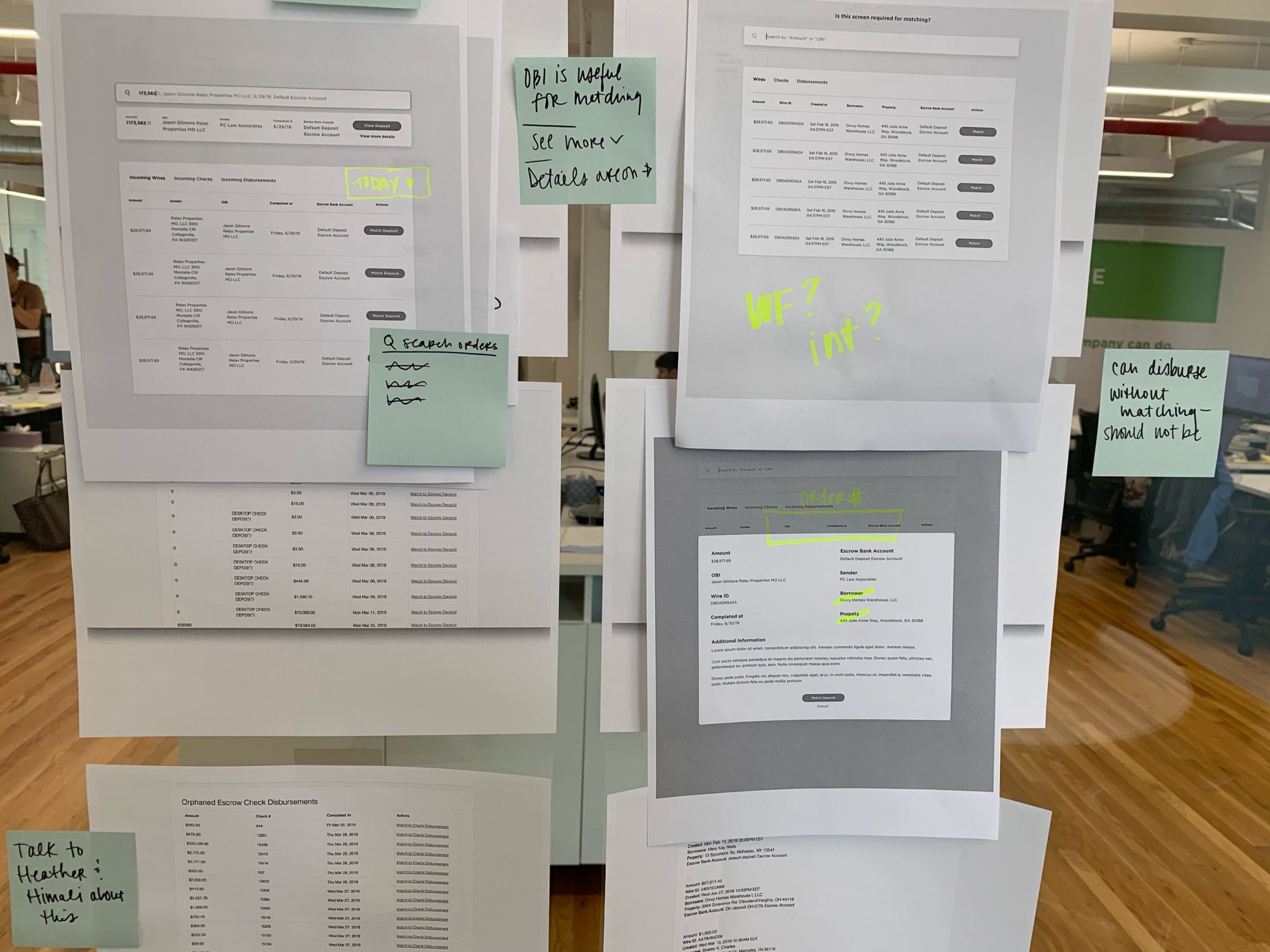

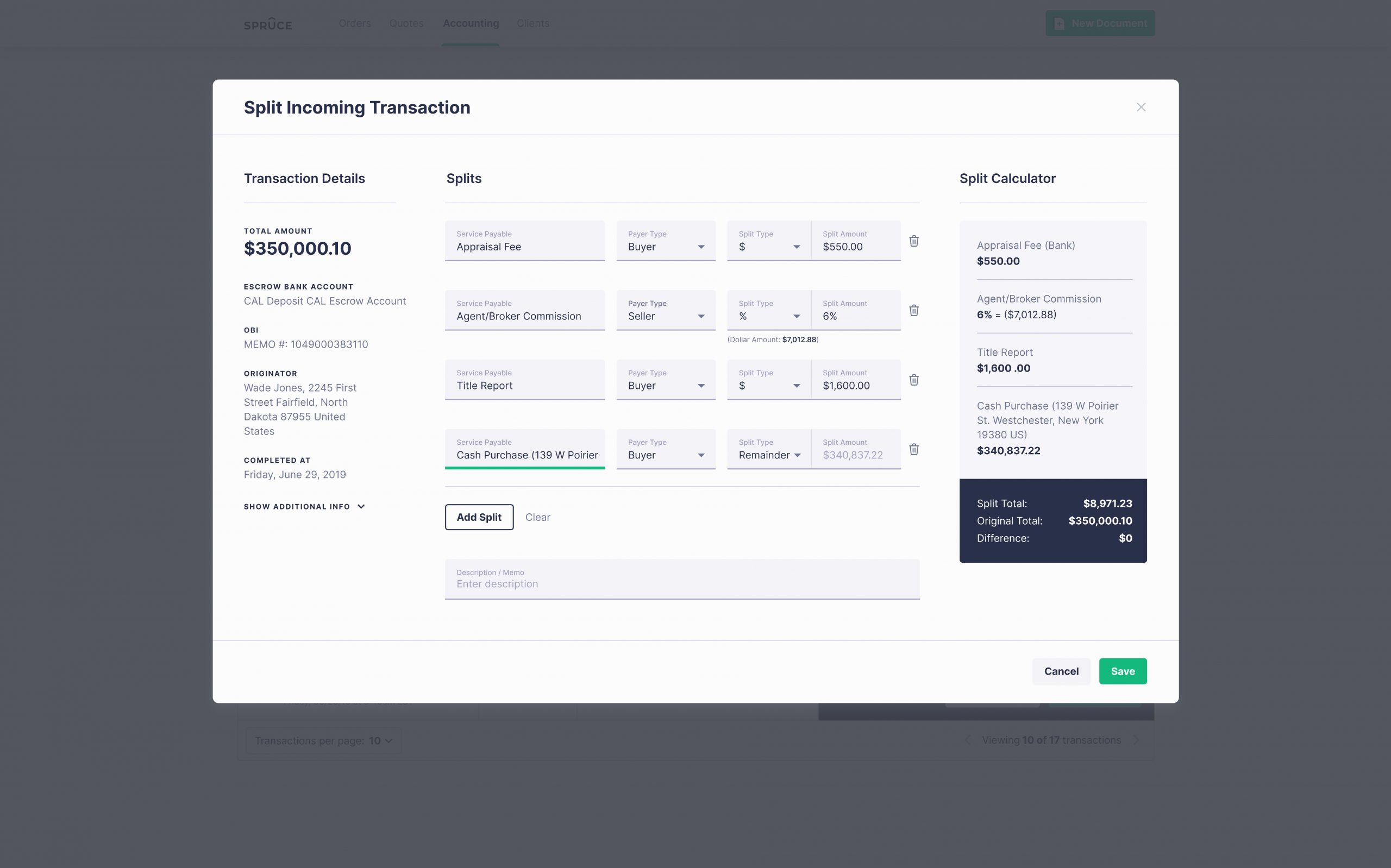

I led the end-to-end redesign of escrow transactions, eliminating $250k+ in annual inefficiencies, cutting manual work by 37%, and speeding up reconciliation by 94%.

(Zillow acquired Spruce in Sept. 2023)